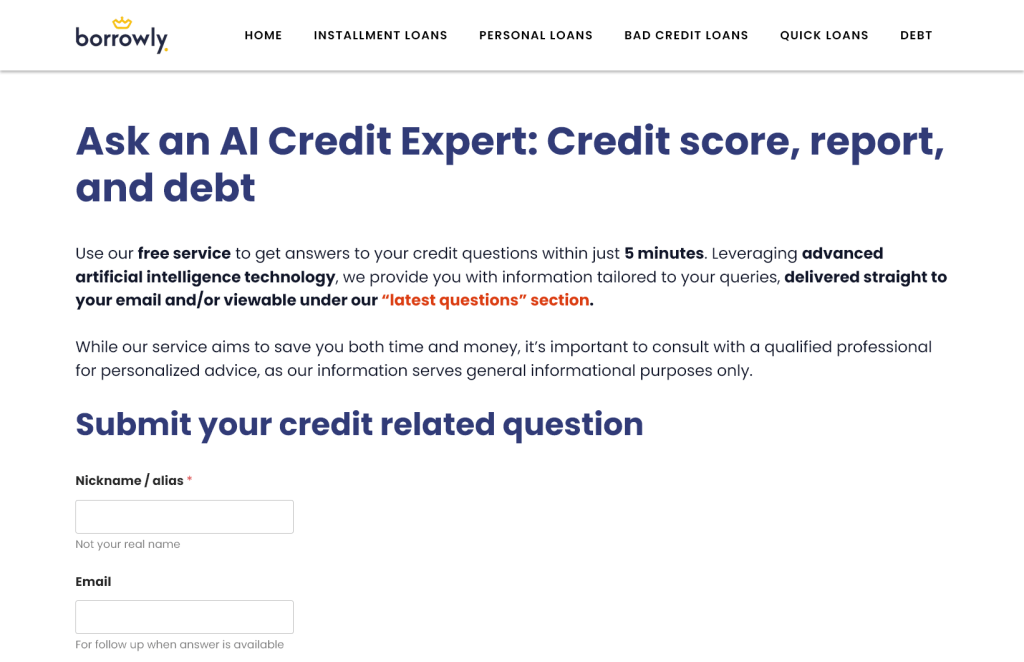

Borrowly’s Ask an AI Credit Expert is a free, user-friendly platform designed to offer general advice on a broad spectrum of credit-related questions. The service employs advanced artificial intelligence technology to generate responses to user queries. These answers are provided within a 5-minute window and are delivered directly to the user’s email. Additionally, the answers are accessible under the “latest questions” section on the website, offering a convenient way to review the information.

One of the distinguishing features of this service is the use of specially crafted prompts that are designed to elicit more accurate and relevant questions related to credit issues. This feature aims to guide users in framing their queries in a way that enables the AI to provide the most pertinent advice. Another unique aspect is the service’s focus on clear presentation. Unlike typical chatbot interfaces, which can sometimes be confusing or cluttered, this platform aims for clarity and ease of understanding in its presentation of information.

The types of credit questions that the service can assist with are diverse, making it a versatile resource for anyone looking to understand or improve their credit situation. Categories include:

- Credit Score Queries: Users can gain insights into the factors that affect their credit score and receive advice on potential improvement strategies.

- Debt Management: The service offers general guidance on effective ways to manage and reduce debt, helping users to make informed decisions.

- Credit Report Errors: Users can learn about the general steps recommended for disputing inaccuracies on their credit report, providing a starting point for resolving such issues.

- Credit Card Utilization: The platform provides information on how credit card usage can impact one’s credit score and what the optimal utilization rates are.

- Loans: Users can discover what criteria lenders generally consider when evaluating loan applications, offering a foundation for improving their chances of approval.

The service is accessible without the need for sign-up, making it an easily reachable resource for quick and credit advice.